Industry-leading prices

Get ultra-competitive spreads and commissions across all asset classes. Receive even better rates as your volume increases.

FX

Spread as low as

0.2

pip

Trade 182 FX spot pairs and 140 forwards across majors, minors, exotics and metals.

CFDs

Spread from

0.4

on US500

Go long or short on 9,000+ instruments with tight spreads & low commissions.

Stocks

Commissions from

$3

on US stocks

Access 19,000+ stocks across core and emerging markets on 36 exchanges worldwide.

Commodities

Commission as low as

$1.25

per lot

Trade a wide range of commodities as CFDs, futures, options, spot pairs, & more.

ASSET MANAGEMENT

Stakelite create customized, integrated stake solutions to meet the unique needs of insurers and pension plans.

INSTITUTIONAL MANAGEMENT

When you select Stakelite to manage institutional assets, you will discover why we’ve earned the reputation for solid performance and equally solid relationships.

WEALTH MANAGEMENT

Your financial goals are uniquely your own, so Stakelite will design a wealth management strategy that’s just for you.

INVESTOR RELATIONS

Stakelite provides advanced stake strategies and wealth management solutions to forward-thinking investors around the world. Through its distinct stake brands Stakelite Management, we offers a diversity of stake approaches, encompassing bottom-up fundamental active management, Responsible Investing, systematic investing and customized implementation of client-specified portfolio exposures. Exemplary service, timely innovation and attractive returns across market cycles have been hallmarks of Stakelite since the origin.

OUR DIVERSITY & INCLUSION STRATEGY

At Stakelite, we want every person to have the opportunity to succeed based on merit, regardless of race, color, religion, creed, ancestry, national origin, sex, age, disability, marital status, citizenship status, sexual orientation, gender identity expression, military or veteran status, or any other criterion. Why is this so important? To us, diverse and inclusive teams enriched with people of distinctive backgrounds make us better. They help us generate better ideas, reach more balanced decisions, engage our communities and help our clients achieve better outcomes.

FINANCIAL PLANNING

These days, it's more important than ever to have a plan. Our version of financial planning not only gives you the confidence to know you're ready for anything, but is also designed to help you reach all your goals in the days ahead.

LEARN MORESTAKE PHILOSOPHY

Stakelite differentiated credit-focused franchise combines relative value trading with a deep understanding of fundamental credit investing and legal and structuring expertise. With an emphasis on risk management, Stakelite opportunistically invests across the capital structure in less efficient segments of the market with the goal of generating consistent, alpha-driven returns across market cycles.

FOCUS

We are focused on global stake strategy. We generally seek to build a concentrated portfolio of scale stake in industries we know well and have developed significant expertise

Culture of transparency

We believe in sharing good (and bad) news early, aligning ourselves with our investors and companies, and truly partnering and empowering management teams. We also don’t charge transaction or monitoring fees to our portfolio companies (and haven’t since our founding)

Commitment to making companies better

We invest for the long haul to support the strategic and financial objectives of outstanding management teams. We believe our deep sector experience allows us to add value and offer insights that enable our companies to flourish.

Industry Insights

Our stake philosophy is enhanced further by the depth of our focus on industry verticals. We have distinguished ourselves as a value-added partner with deep sector insights in select verticals which enables us to take a differentiated approach to sourcing, diligence, and value creation initiatives

RESPONSIBLE INVESTING

Stakelite Partners is committed to conducting business in a safe, responsible, and ethical manner. These principals guide our decision-making throughout the stake lifecycle.

From the onset of the stake process, we pursue ideas inspired by environmental, social, and governance (‘ESG’) issues and participate in industries engaged with these themes. All companies in which we invest are first vetted by our professionals, who work closely with expert advisors, to identify and mitigate potential ESG conflicts. Our ESG due diligence program requires an assessment of ten key ESG areas which may impact the current or future performance of a company. One Equity Partners will forego any stake that fails to meet its ESG standards.

As stakes mature, One Equity Partners seeks to continually improve upon ESG reviews and recommendations, and, together with management, works to ensure that ESG issues are prioritized through to and beyond exit.

PROFESSIONALLY MANAGED STAKE PORTFOLIOS

Time is a precious commodity. Researching stakes in ever-changing markets and handling stake transactions are more than most people have time for. Venture Capital Finance's Asset Management Solutions program allows you to delegate the daily management of your assets and invest with confidence, knowing that your portfolio is in the hands of experienced professionals.

DIFFERENT GOALS REQUIRE DIFFERENT APPROACHES

At Stakelite we recognize that each investor is unique. That’s why we take a personalized approach to developing an asset management strategy by selecting stake portfolios that closely match your goals, tolerance for risk, and expectation for returns.

OUR VALUES

At the heart of our business are our partners: the entrepreneurs and management teams we back; the investors in our funds; the advisers and intermediaries we work with; and the banks and other lending institutions to our deals.

Winning

We are here to win. We are constantly improving, and are committed to out-thinking and out-executing our competitors. We take on what others dismiss as impossible, and solve the hard problems that others walk away from. This is why we hire the best.

Integrity

We do things the right way, without compromise, the first time – every time. We are direct, decisive and, above all, accountable. We practice sound judgment and common sense in our actions that conforms to the letter and spirit of the law at all times. We win on the merits, with integrity.

Learning

We are driven by a thirst for knowledge. We are constantly learning – from each other and from inspired thinkers around the world. We passionately pursue new ideas, new innovations and new strategies that will strengthen our competitive advantage

SECTORS

FIXED INCOME

Our comprehensive approach to private wealth management will help you and your family enjoy your wealth today. FINANCIAL THOUGHT LEADERS, ON YOUR TEAM

MULTI ASSETS

Multi-asset income solutions designed to provide clients with stable, sustainable income in today’s low-yield environment EXPERTISE ACROSS A WIDE RANGE OF STRATEGIES

ENERGY & SUSTAINABILITY

We are one of the world's largest investors in renewable power, with approximately 21,000 megawatts of generating capacity RENEWABLE POWER FOR A CLEANER, BRIGHTER TOMORROW

HOW WE WORK

|

|

Stakelite is a tightly knit group working together with management teams toward common goals. We have more than 70 stake professionals, including 24 partners with an average tenure at Stakelite of more than a decade. This allows us to devote substantial time to the companies in which we invest. |

|

|

Our objective is to work with portfolio company leadership and create a backdrop in which companies can thrive. We encourage management teams to invest alongside us, and our forward-thinking approach and philosophy to leave companies better than when we found them also means that portfolio company employees often choose to invest alongside Stakelite as well. |

|

|

We believe that people thrive when they are working toward a common and focused goal. We are proud of our transparency and alignment of interest with our portfolio companies and investors. We believe our focus and significant skin in the game allows us to build true, successful partnerships. |

OUR PURPOSE

This means supporting our colleagues, customers and clients, and the communities and environment in which they operate, for the benefit of all our stakeholders. It means helping people and businesses unlock their potential and plan for the future with confidence, building relationships that stand the test of time. And it means that we continue to be there for the long-term, whatever the climate, making decisions that are right for today and for generations to come.

To achieve this, our long-term strategic approach place exceptional service at the heart of everything we do. Each of our diverse, specialist businesses have a deep industry knowledge, so they can understand the challenges and opportunities that our customers and clients face. We support the unique needs of our customers and clients to ensure that they thrive, rather than simply survive, whatever the market conditions.

We believe in putting our customers and clients first. Our cultural attributes bring out the very best of our people, skills and strong reputation that we have built with our stakeholders over many years. A combination of expertise, service and relationships with teamwork, integrity and prudence underpins our approach and gives us the tools to thrive over the long term.

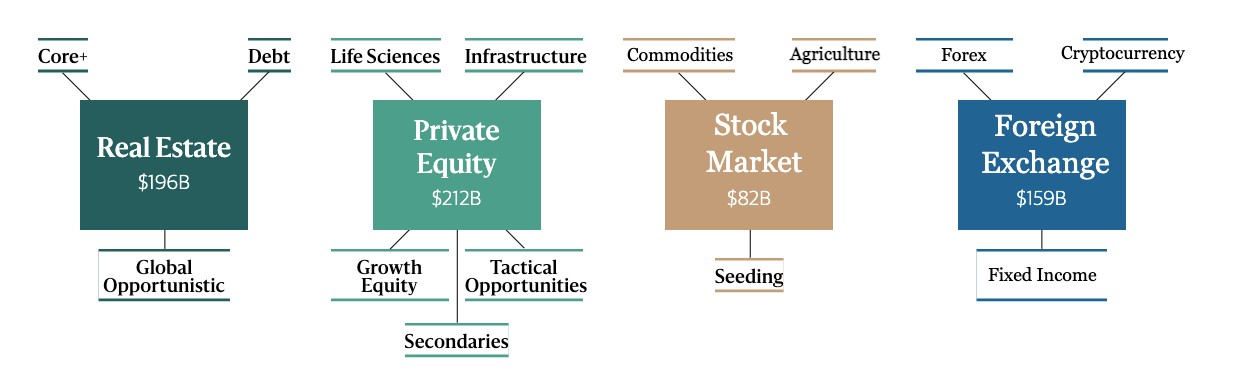

$649B AUM

We continue to build on our track record to innovate into new strategies, drive growth, and serve our investors.

ENVIRONMENT

Our Buyout Funds’ portfolio can be qualified as ‘asset light’ and the most material environmental indicator for many companies is electricity usage.

SOCIAL

processes and practices are in place across the portfolio to support the wellbeing of the workforce.

GOVERNANCE

good corporate governance and a code of ethics which guides our business activities is the foundation of effective corporate management.

LIVE LONGER, BETTER.

What is long-term care? Long-term care is something that most people may not think they need, or might think is covered by health insurance or Medicare. The fact is, if you live to be 65, there's a 70% chance you'll eventually need some kind of long-term care.1 But aging isn't the only reason to plan for long-term care—it's there for you if a chronic illness or disabling injury prevents you from living on your own or properly caring for yourself, no matter how old you are. Long-term care helps with day-to-day tasks like bathing, eating, getting dressed, and getting in and out of bed. And it includes care provided by nursing homes, assisted living facilities, adult day care centers, hospice facilities, and skilled nurses or home health aides in your (or your loved one's) home. If you're not the one who needs it, there's a good chance you'll need to help care for a loved one.2 And having a long-term care plan in place can help you continue to live well without sacrificing the income, stakes, and savings you've worked so hard for.

OUR PEOPLE

We focus on attracting exceptionally talented people and rewarding initiative, independent thinking and integrity. Our team’s breadth of skills and deep expertise are a critical source of intellectual capital.

OUR SCALE

Investing across regions, industries and asset classes gives us the knowledge, resources and critical mass to take advantage of opportunities on a global scale.

OUR PERFORMANCE

Our performance is characterized by superior risk-adjusted returns across a broad and expanding range of asset classes and through all types of economic conditions.